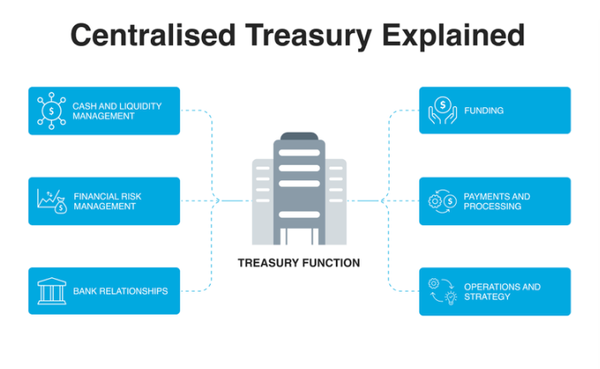

Centralised Treasury Explained

In turbulent times, it is more difficult to achieve higher risk mitigation, control, and visibility over cash. This has been a driver for centralisation in recent years and, as CFOs and treasurers seek to gain an accurate view of the cash held by their organisations, we have seen the topic of centralised treasury picking up interest. In this blog post, we'll dive into what centralised treasury entails, explore its benefits, shed light on the importance of centralised foreign exchange (FX), and d...